Fibonacci Retracements Definition

Contents:

To avoid having too many lines and indicators, you can opt to stick to a specific time frame like a 60-minute chart. The ideal fib ranges will be plotting a high to low and low to high points using the weekly charts back to 2009. If there range is too wide between fib points, then a 15-minute or 5-minute high to low and low to high can be used.

Toggles the level’s price absolute or percent value visibility beside the level. The checkbox toggles the visibility of the trend line and switches beside set it’s color, opacity, thickness and style. In regards to the 3-wave patterns, Fibonacci Retracement indicates how far a corrective wave B could go before wave C is born.

How To Calculate Fibonacci Retracement Levels?

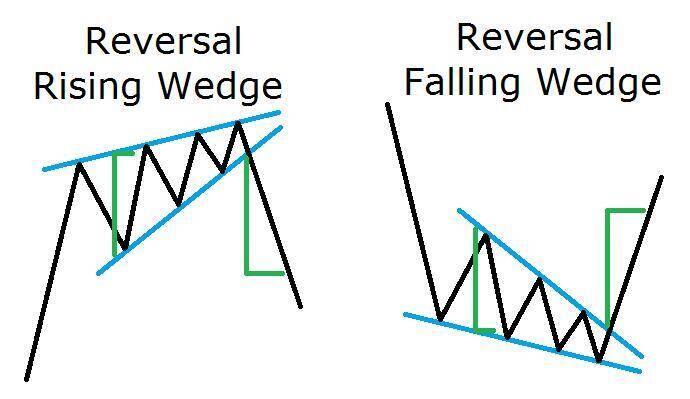

The idea is to watch where a price goes when it reaches one of the three primary retracement numbers and see if the price is going up or down. If it’s going up, it might be a good buy; if it’s going down, it might be time to get rid of it. The idea is to watch the trend, identify the retracement, then trade in the direction of the trend. This means that orders tend to congregate around the same price levels, which could push the price in the desired direction. However, Fibonacci retracements require a high level of understanding to be used effectively. Simply drawing lines on a price chart at the Fibonacci percentages will likely not yield positive results unless traders know what they are looking for.

We will help to challenge your ideas, skills, and perceptions of the stock market. Every day people join our community and we welcome them with open arms. We are much more than just a place to learn how to trade stocks. Our chat rooms will provide you with an opportunity to learn how to trade stocks, options, and futures. You’ll see how other members are doing it, share charts, share ideas and gain knowledge. Shallow retracements occur, but catching these requires a closer watch and quicker trigger finger.

- Rather, retracements within these zones can be explained by statistical chance alone.

- Generating the next number by adding 3 numbers , 4 numbers , or more.

- To fully harness this technical indicator in your trend-trading strategy, it’s essential to understand where it triumphs and where it can fall short.

- Fibonacci ellipses identify underlying structure of price moves.

Traders believe the Fibonacci series has its application in stock charts as it identified potential retracement levels. Chart 1 shows Home Depot retracing around 50% of its prior advance. In technical analysis, Fibonacci retracement levels indicate key areas where a stock may reverse or stall.

Kepler pointed out the presence of the Fibonacci sequence in nature, using it to explain the (golden ratio-related) pentagonal form of some flowers. Field daisies most often have petals in counts of Fibonacci numbers. Braun discovered that the parastichies of plants were frequently expressed as fractions involving Fibonacci numbers. This helps traders see at which point the price may return back to a previous level before continuing on with the trend. I have found this to be true and will show you how markets give us internal price clues XRP that tell us when we should make adjustments like this and when we should not.” -Brown, Constance. As we will see later in the section covering Fibonacci extensions, it is remarkable to note the price action as the S&P 500 marches to new highs on the chart.

Fibonacci Retracement

Fibonacci retracement levels were formulated in ancient India between 450 and 200 BCE. A trader sees the retracement occurring between the level or close to the level. Further, he/she may proceed to “line up” the indicator with these levels and conclude that the effect is indeed real when it isn’t.

For instance, traders tend to hold onto gains or mitigate losses at specific price points that ominously coincide with the golden ratio. The timeframe selection is crucial when applying Fibonacci retracement. Traders can use the tool on various timeframes, including intraday, daily, weekly, and monthly charts.

News, Research and Analysis

When plotted correctly, the “fib” levels can be uncanny in their accuracy and effectiveness for catching tops and bottoms. They act as inflection points, where the stock will either deflect off the level or break through eventually, almost like a speed bump. When the fib levels converge with other indicators or have overlapping price levels, they become extra powerful levels. Like every other technical indicator, Fibonacci retracements also have some flaws and you should be aware of them before using this indicator to invest your capital in the financial markets.

The areas or levels defined by the retracement values can give the analyst a better idea about future price movements. Remember that as price moves, levels that were once considered to be resistance can switch to being support levels. Values greater than 1 are external retracement levels, while values less than 0 are extensions. A checkbox is available for each defined level, which allows that level to be turned on or off for display purposes. Using the Fibonacci retracement tool isn’t useful for determining the overall trend in price but can help to predict levels of support and resistance within a large trend reversal.

Fibonacci Sequence and Ratios

In addition, I found no strong philosophy on why these levels should be so important in global financial markets. Fibonacci extensions (or “Fib extensions”) are used to determine price targets after the prevailing trend has resumed. This can be a powerful strategy to predict the extent of retracements in different waves of a particular market structure. Determine significant support and resistance levels with the help of pivot points. Now, let’s see how we would use the Fibonacci retracement tool during a downtrend.

- Just choose the course level that you’re most interested in and get started on the right path now.

- But Fibonacci filters for trading signals are, like all technical indicators, imperfect at best.

- Bear TrapsA bear trap is a technical stock trading pattern reflecting a misleading reversal of an upward trend in the financial market.

The next step is to get the largest correcting wave for each wave that we have found as a result of the first breakdown. The example shown in Figure 3b is the breakdown of the wave 1. By obtaining the largest correcting wave Y we can breakdown the wave 1 into three waves – X, Y and Z. After doing this I calculate the correction size in % by dividing the length of Y on the length of X.

Toggles the visibility and opacity for the background fill between the https://traderoom.info/‘s levels. The Elliott Wave Theory (“EWT”) is named after Ralph Nelson Elliott and is a method of technical analysis based on crowd psychology. The first support level is the one marked by 38.2% and if price moves through it then it becomes a resistance line and a new support level shifts to Fibonacci level of 61.8%. The most common approach to working with corrections is to relate the size of a correction to a percentage of a prior impulsive market move.

When a market trend retraces to one of these levels, it is often viewed as a potential buying or selling opportunity. It helps traders trade in the market when stocks rally sharply, and all they have to do is wait for retracement or correction to happen. After identifying Fibonacci levels (23.6%, 38.2%, and 61.8%), traders can decide whether to buy or sell that stock. For example, if a downtrend starts to go up, they can analyze the future market trend using the retracement level and decide when to sell an asset to get the best value.

Yes, we work hard every day to teach day trading, swing trading, options futures, scalping, and all that fun trading stuff. But we also like to teach you what’s beneath the Foundation of the stock market. In fact, it will often retrace to a Fibonacci retracement level, which can indicate an entry or exit point in the direction of the original trend. Nevertheless, it is crucial to recognize that Fibonacci lines are merely a confirmation tool.

Fibonacci Techniques for Profitable Trading – Investopedia

Fibonacci Techniques for Profitable Trading.

Posted: Sat, 02 Apr 2022 07:00:00 GMT [source]

As a result, employing this indicator alongside other technical analysis devices is highly recommended. Generally, the more confirming factors are present, the more robust and reliable a trade signal is likely to be. The tool can also be used across various asset classes, including foreign exchange, stocks, commodities, cryptocurrencies, futures, options, and index funds. By combining Fibonacci retracement with these indicators, traders can develop more robust trading strategies that improve their chances of success.

In this context, the Fibonacci retracement tool may provide insights into potential resistance levels if the market starts to move up. While technically not a Fibonacci ratio, some traders also consider the 50% level to have some significance, as it represents the midpoint of the price range. Now, let’s take a look at some examples of how to apply Fibonacci retracement levels to the currency markets.

It is based on the idea that markets will often retrace a predictable portion of a move, after which they will continue to move in the original direction. Fibonacci retracement is a technical analysis tool used to identify potential levels of support and resistance in a market trend. Keep in mind that these retracement levels are not hard reversal points. It is at this point that traders should employ other aspects of technical analysis to identify or confirm a reversal.

Pivot Point: Definition, Formulas, and How to Calculate – Investopedia

Pivot Point: Definition, Formulas, and How to Calculate.

Posted: Sun, 26 Mar 2017 07:48:33 GMT [source]

The Fibonacci retracement method uses a set of key numbers called Fibonacci ratios to identify the support and resistance levels of an asset/stock/cryptocurrency. In short, traders will look at Fibonacci ratios to determine where the market will resume its previous rise or fall. So, for example, during an uptrend, you might go long on a retracement down to a key support level (61.8% in the example below). Fibonacci retracement levels, like any other technical indicator, can produce false signals. The presence of market noise can sometimes lead traders to make incorrect decisions based on these levels.

The Fibonacci retracement levels are all derived from this number string. After the sequence gets going, dividing one number by the next number yields 0.618, or 61.8%. Divide a number by the second number to its right, and the result is 0.382 or 38.2%.

ECI and PCE are hot for June. What does it mean for the Fed? – FOREX.com

ECI and PCE are hot for June. What does it mean for the Fed?.

Posted: Fri, 29 Jul 2022 07:00:00 GMT [source]

fibonacci retracement definition retracements suffer from the same drawbacks as other universal trading tools, so they are best used in conjunction with other indicators. If you ask any technical trader which charting tool they rely on the most, Fibonacci retracement would probably come fairly high up on the list. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey. Fibonacci retracements are used immediately after a strong price movement either up or down.

Instead, Fibonacci introduced these numbers to western Europe after learning about them from Indian merchants. Therefore, many traders believe that these numbers also have relevance in financial markets. Cory is an expert on stock, forex and futures price action trading strategies. In essense, what the G10 histograms show is that price action at the Fibonacci retracement levels is not significantly distinct compared to other nearby levels. To define the Fibonacci retracement levels during an up-trend, we need to pick an appropriate major minimum and maximum of the wave that is experiencing a correction. Buying at the 38.2% retracement level then selling at the 23.6% level could be an interesting strategy.